Špeciálne akcie

Sexshop Erotikcentrum.sk, erotické pomôcky pre Váš intímny život

Sex shop Erotikcentrum.sk vás víta na mieste, ktoré v sebe spája svet erotiky a rozkoše s diskrétnosťou, profesionalitou a odbornosťou. Sme tu pre váš intímny život a našou snahou je obohacovať ho. Rozhodli sme sa zmeniť váš spôsob života a užívania si sexuality. Prinášame vám nový koncept erotického obchodu, ktorý presadzuje tradičné obchody s úplne inou víziou sexuality a zameraním na vaše sexuálne zdravie. Časy sa rýchlo menia a podľa toho sa musí zmeniť aj spôsob, akým rozumieme pojmu sexualita a užívanie si ju.

Erotikcentrum je viac ako internetový sexshop. Snažíme sa vytvoriť miesto, kde sa cítite bezpečne, kde sa môžete učiť a zabávať sa. Naším poslaním je to, aby ste boli o niečo šťastnejší a aby ste si svoju sexualitu užili úplne a oveľa príjemnejšie a intenzívnejšie.

Náš tím tvoria ľudia so sexuálnym šťastím, ktorý sa snažia sprístupňovať zábavný a plnohodnotný sexuálny život každému.

ErotikCentrum je sexshop, kde nájdete erotické pomôcky za nízke ceny

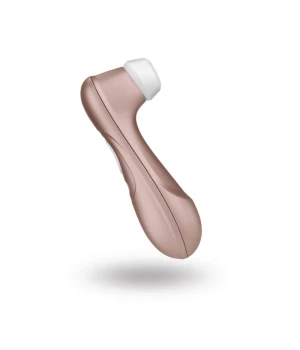

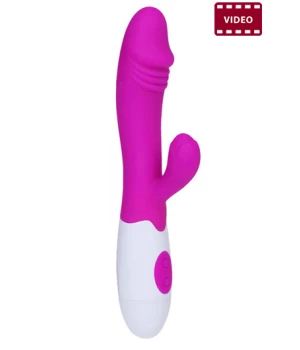

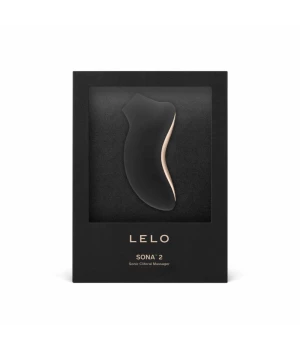

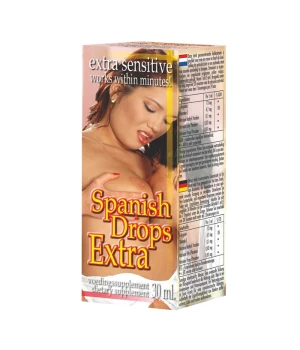

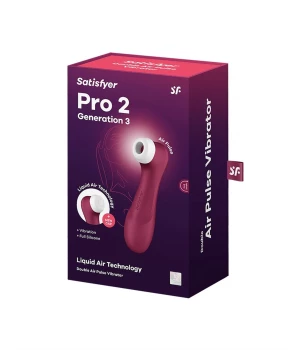

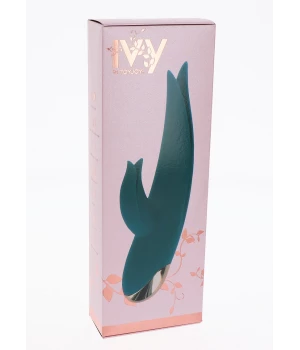

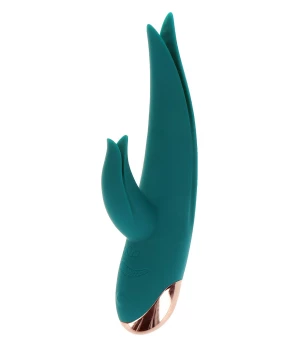

Našim cieľom je vtiahnuť vás do najnovších kútov sexuálnych hračiek a erotických pomôcok. Na jednom mieste nájdete ozaj širokú ponuku, erotické pomôcky od výmyslu sveta. Vibrátory, vagíny a masturbátory, análne pomôcky, afrodiziaká, bdsm pomôcky či luxusné erotické spodné prádlo.

Na svoje si prídu ženy aj muži, aj tí náročnejší nadšenci sexuálnych praktík. Z našej ponuky erotických pomôcok si dokáže vybrať každý. Či už preferujete luxusný tovar, alebo tovar za tie najnižšie ceny. Dbáme na kvalitu produktov, a preto pravidelne pre vás testujeme nové produkty. Zároveň sa náš sexshop neustále vzdeláva v oblasti erotiky, aby ste mali k dispozícií vždy tie najhorúcejšie novinky zo sveta erotických pomôcok.

Veľkou výhodou nášho erotického obchodu je vlastný sklad. Na svoj tovar nemusíte čakať kým sa naskladní a to zaručuje rýchlu expedíciu tovaru a s tým spojené rýchle dodanie erotických pomôcok priamo k vám.

Diskrétnosť doručenia erotických pomôcok

Medzi našou hlavnou prioritou je vaše súkromie. Dbáme na to, aby sa pri doručovaní zásielky nikto nedozvedel, že ste si zásielku objednali zo sexshopu.

Náš sex shop spolupracuje so sexuologičkou, máte preto možnosť poradiť sa s odborníkom v akejkoľvek oblasti. Používanie erotických pomôcok už nieje tabuizovanou témou ako kedysi. Erotické pomôcky vám v dnešnej dobe dokážu pomôcť po psychickej či zdravotnej stránke. Navyše, ku každej objednávke pridávame aj darček, ďalší erotický produkt, aby sme ešte viac potešili našich zákazníkov. Už len stačí vybrať si tú svoju erotickú hračku a užívať si sexuálny život plný rozkoše!

Erotický obchod a výhody

Postaráme sa aj o ten najmenší detail od chvíle, keď si prezeráte našu stránku, až po moment, keď si balíček doma diskrétne otvoríte, aby ste si ho užili. Vďaka vám sa náš online sexshop stáva lídrom na trhu s erotickým tovarom na slovensku. Chceli by sme, aby sme sa stali dôveryhodným sexshopom, preto vám celý proces nákupu a výberu uľahčujeme, aby ste mohli nákup uskutočniť bezpečne a hlavne diskrétne.

Sme veľmi rýchli: Objednávky odosielame expresne rýchlo. Pri objednávke do 12:00 budú vaše objednávky expedované ešte v daný deň. Disponujeme vlastným skladom, a preto nemusíme čakať kým vami objednaná erotická pomôcka príde od dodávateľa a vieme ju hneď odoslať. Objednávky k vám dokážu prísť už v daný deň objednania, alebo do 3 pracovných dní. To záleží od výberu prepravcu, ktorého si sami zvolíte.

Sme diskrétni: Naše zásielky sú balené a dodávané v nepriehľadných obaloch či krabiciach bez akejkoľvek značky alebo nálepky, ktorá by mohla napovedať, že v balíku sa nachádza erotický tovar. Diskrétna je aj naša adresa odosielateľa, ktorá nenapovedá, že ide o sexshop. Preto si môžete byť istý, že vaše fantázie ostanú utajené. Ani doručovatelia nevedia, že vám vezú erotické pomôcky.

Odmeňujeme: K objednávkam rozdávame darčeky, ktoré vyberáme na základe výšky objednávky. Môžete sa tak tešiť, že náš sexshop erotikcentrum.sk pribalí k vašej objednávke lubrikačné gély, kondómy, vibrátory, krúžky na penis, bičíky a rôzne iné sexuálne hračky, ktoré vás určite potešia.